Here's Why You Should Invest OUTSIDE the US

Michael Carroll - Aug 19, 2024

The US stock market has been one of the world's best-performing for over a decade.

This long stretch of strong performance has led many to abandon diversification and invest exclusively in S&P 500 ETFs.

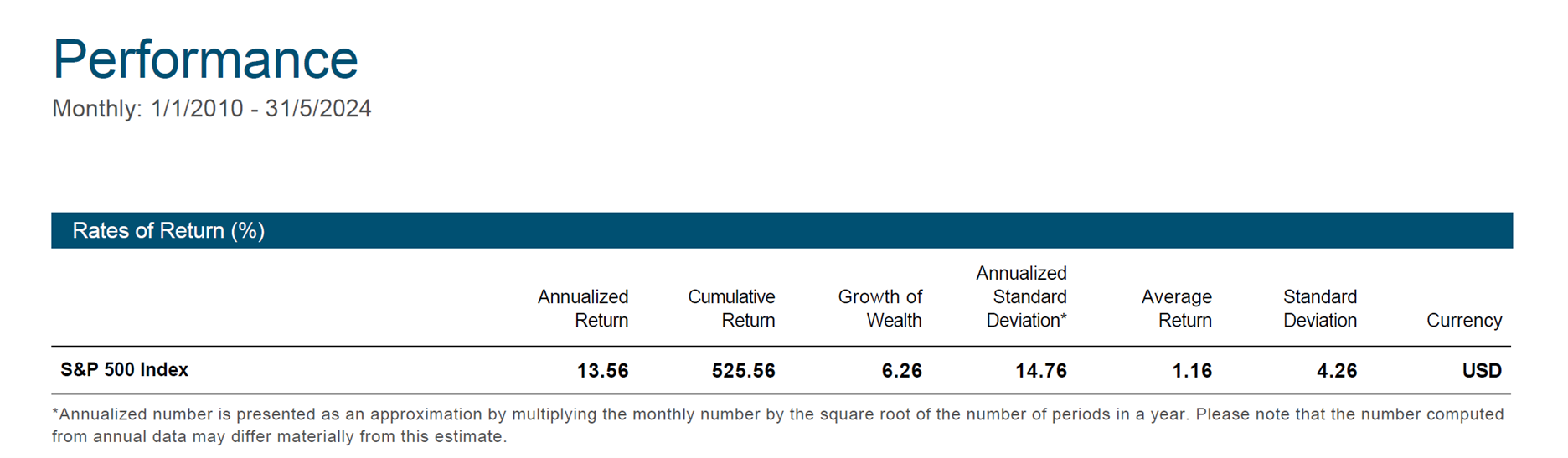

Since 2010, investors who pursued this strategy have likely been extremely happy. If you'd invested in the S&P 500 at the start of 2010, you would've received an over 500% return.

Moving forward, I don't believe investing exclusively in the S&P 500 is a good strategy.

To be clear, I'm not suggesting you shouldn't invest in the S&P 500. It's the 500 biggest companies from the world's largest and most dynamic economy. It makes sense to have an allocation to it.

However, only investing in the S&P 500 leaves out about 2500 other public US companies and thousands more worldwide.

Diversification beyond the S&P 500 should mean more reliable outcomes to help you reach your goals.

After such a seemingly long time of S&P 500 outperformance, why do I believe this?

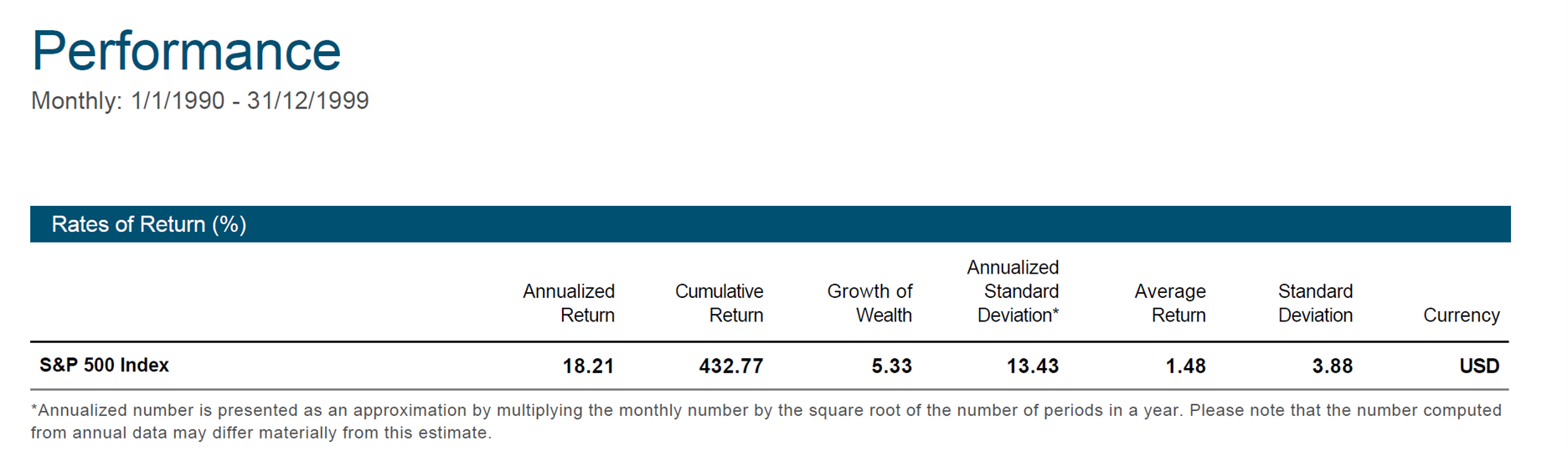

In the 1990s, the S&P 500 also had a great decade, returning over 400% to investors.

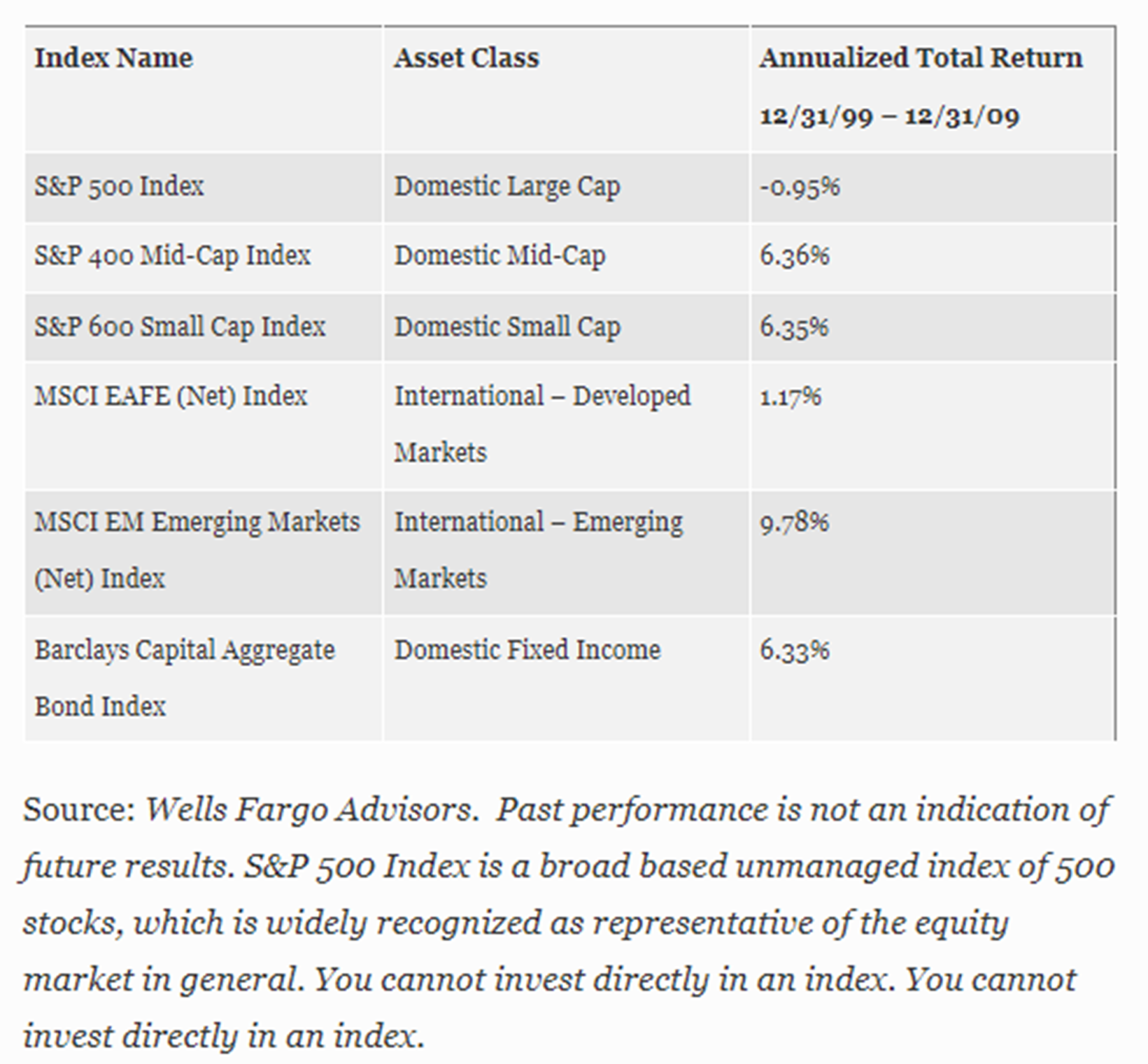

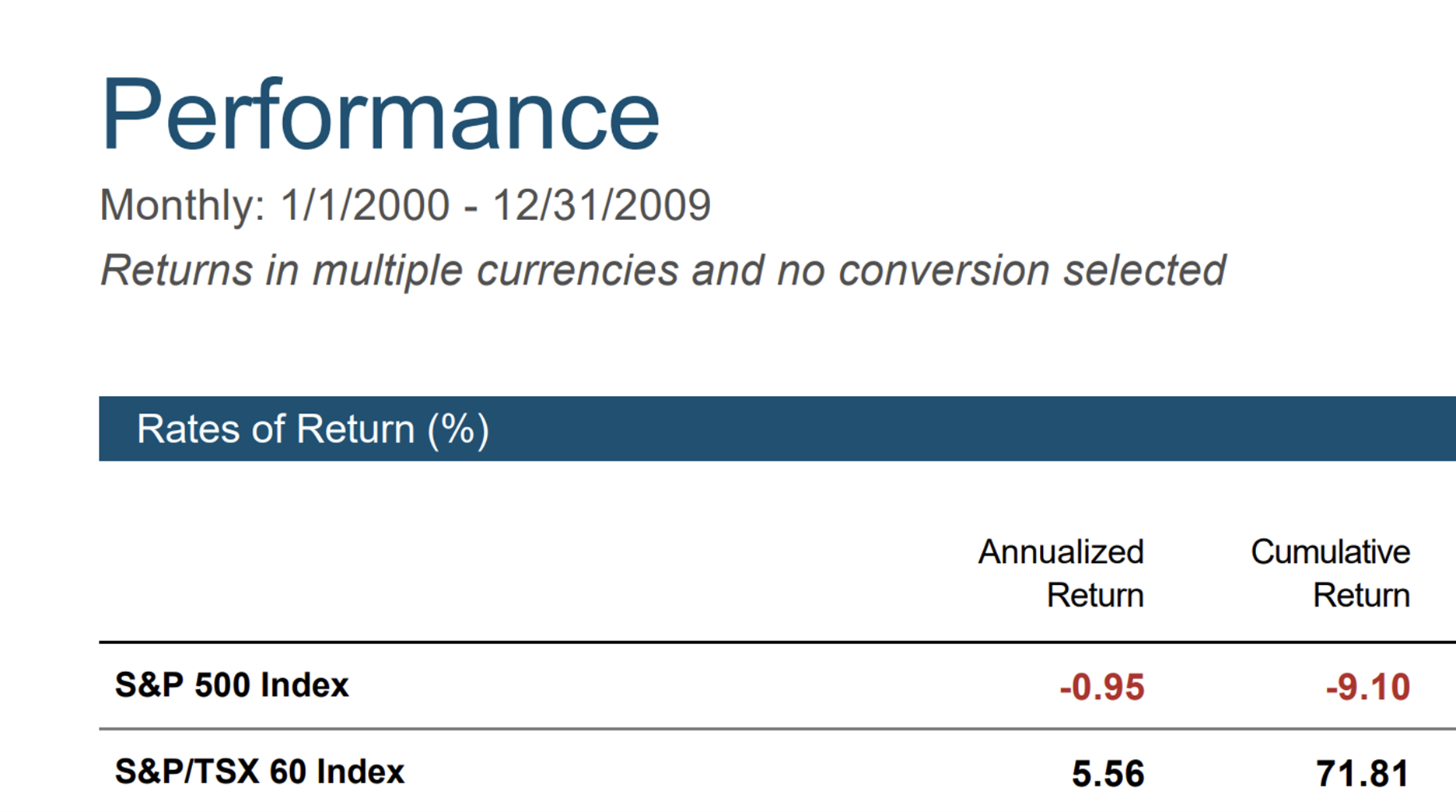

This did not continue into the 2000s. The period of 2000-2010 is known as the "lost decade" for the S&P 500 as it had a negative return.

This wouldn't have hurt too much if you owned a more diversified portfolio. Smaller US companies not in the S&P 500, Canadian, & international stocks all had positive returns.

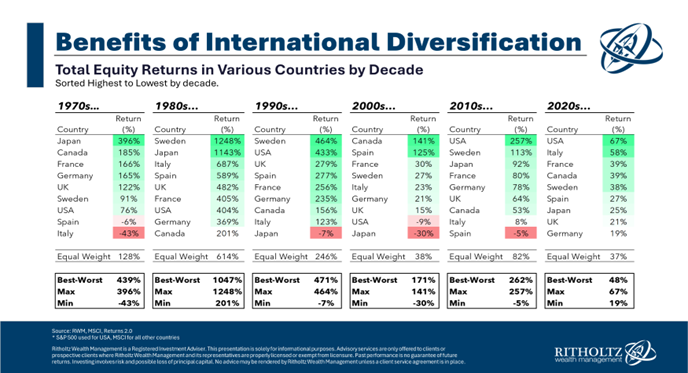

You can go back further and find a similar story. The US has historically had a strong-performing market. But it's not always the best performing.

As an investor, one of the best traits you can have is thinking long-term and avoiding recency bias.

Trends don't persist forever.

This chart helps to illustrate my point in two ways.

The first is that, if you look through the years, you can see that it's not uncommon for the best-performing country one year to be near the bottom the following year.

The second is that from 2003-2022, Denmark was the highest-performing developed country. In 2022, would you use that information to invest in Denmark exclusively?

Instead of betting on one country, a better approach is to diversify worldwide. History shows that the stock market moves in cycles and what happened in the last decade normally doesn't persist into the next one.

Owning stocks from throughout the world puts you in a better position to have a positive outcome as an investor.

If a group of countries underperforms, it won't matter to you because chances are that you will be simultaneously invested in another group of countries that are outperforming.

In other words, betting on the world will produce more reliable outcomes than betting on a country.

*The views and opinions expressed in this article may not necessarily reflect those of IPC Securities Corporation.

[1] https://my.dimensional.com/which-country-will-outperform-heres-why-it-shouldnt-matter